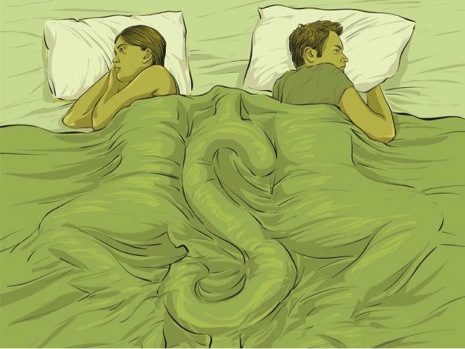

Even with dual incomes supporting more households, and prevalent financial planning options available, couples continue to report money as the number one reason they fight. A recent study from Kansas State University says financial disagreements may be the strongest indicator of coming divorce, while Utah State University has found that couples who fight about finances at least once a week are 30% more likely to split.

Merging assets, managing debts, budgeting, investing, planning for emergencies, and financial secrets often cause the conflict, though a USA Today poll says problems are typically driven by a basic breakdown in communication. Two-thirds of couples who report mounting money problems admit never even discussing their shared financial life before getting married. “Couples will talk about sex, religion, and many other dicey things,” Syble Solomon, the motivational speaker behind ‘Money Habitudes’, says in the referenced USA Today story. “But when it comes to money, couples are silent.”

Topics for Couples to Discuss before Marriage

Couples, then, should discuss a healthy financial life before marriage, and not overlook intangible details years away. According to Sandra Weng, a licensed therapist and certified divorce financial analyst, the following issues are topics couples should talk about in order to avoid stress and disagreement later in life.

- Reduced Circumstances. Couples who seek financial guidance may not adequately plan for every scenario. For a slew of reasons (economic changes or layoffs), they may encounter hardship previously unconsidered. This readjustment causes couples to ask themselves, “Can we redefine our relationship in a way that is not based on a previous lifestyle?”. Unfortunately, for most, the answer is “no.”

- One-Party Mistakes. Problems may exist when a spouse makes a financial mistake that affects the marriage and/or family. This often happens when one makes financial decisions without informing or consulting the other, leading to a series of finger pointing, blame, and trust issues. Thus, joint decisions are important. Couples should talk about their assets, debts, and investments so that both parties are informed and on notice of the potential risks.

- When Parents Get Involved. The toughest choice of a marriage may be the one that feels like choosing between your spouse and a family member. For example, when one spouse’s aging parent requires financial assistance and support, a couple is often faced with the difficult choice of what to do. Many spouses may feel ethically required to offer help, even at the expense of themselves or their marriage. It is important for couples to talk about such scenarios before they become a problem.

- Kids. Often, “doing right” by the children will keep a couple together, even though the financial challenges that children pose can be detrimental to marriages. Changing circumstances play a huge part in what a parent may feel comfortable providing, and as a couple’s assets change, one child may not receive an opportunity another did. Now more than ever, children are returning home in their mid-20’s, expecting sanctuary from the harsh realities of an unfavorable job market. This creates a boiling point for parents, who may have different expectations for their children’s own means of survival.

- Uncertainty. In the last 30 years, many couples have witnessed their money ride the financial roller coaster up and down. For many, there is a certain sort of low-grade, long-term economic uncertainty that is pervasive despite the best financial planning. Some couples handle this stress better than others, but the enduring anxiety that accompanies the rise and fall of the economic environment can slowly tear away at a marriage.

Long-term success in the face of financial uncertainty depends upon planning for the unexpected, yet simple measures can prevent complicated arguments. The most basic practices (often taken for granted) deserve another look.

Sources:

“Money Issues That Can Test Even A Rock Solid Marriage” by Sandra Weng, New York Times. http://www.nytimes.com/2009/11/07/your-money/household-budgeting/07money.html

“5 Financial Mistakes That Ruin Your Marriage” by Nancy Anderson, Forbes Magazine. http://www.forbes.com/sites/financialfinesse/2011/11/10/5-financial-mistakes-that-ruin-your-marriage-2/